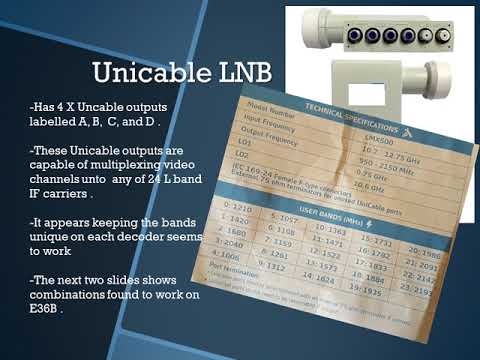

Hi guys, this is a bio. This is going to be a short description of what you need to do in setting up two decoders to work off of one unique cable. That's using one of these unique cable LNBs. As you will see on this slide, I'm just basically going to point out how you can set the tuning bands on two separate decoders so they don't crash. So they can both work on the same unique cable coming from you and Tara. Yes, a quick explanation of what the unique cable modem is. Oh, sorry, that's a mistake. It's actually a unique cable LNB. So, this unique cable LNB has multiple inputs, specifically the one labeled unique Abel. They're the first four off of any of those outputs. You can connect more than one modem, and each of those modems is able to tune independently. Because those outputs have multiplexed L-band carriers, in fact, 24 L-band carriers that can be accessed by any single one of these unique Abel outputs. So basically, it makes it easier, makes cabling more straightforward for where you need to install, for instance, a primary and secondary code in the same premises. In the sense that you would not have to run two different cables from the antenna. One cable supported with splitters will do the trick. But then what you need to take care of is to make sure that when you configure each of those modems or decoders, what you don't need to do is to make sure that you set the user bands such that they don't clash. As an example, this screen here is how I would set up the primary decoder. Do you notice that on this primary decoder we're using the user bands 0, 1, and 2? Now, the...

Award-winning PDF software

4137 Form: What You Should Know

Unreported tips are part of the tip pool, which is the amount of tips taken in by establishments in exchange for services rendered. You can calculate your Tip Income Pool if you are claiming Social Security (or Medicare) retirement, disability, survivor, or disability and your employer doesn't share that information with you. Tip Pool Calculator You may not have to file a return if all the following conditions are met: The total tips received do not exceed 20 for any calendar month; No employer contributions to the tip pool were made; No tips were allocated to employees; A social security account for any tips received is in place, so tips and amounts in the account do not appear on the tax form. The amount of tips you report for a single pay period is the amount that falls in the tip income pool and is includable in income when you file your return. What counts as unreported tips? You cannot file for social security benefits if you are claiming Social Security (or Medicare) retirement, disability, survivor, or disability benefits. Your Social Security or Medicare benefits may be disabled if your employer pays or has paid you benefits and your Social Security or Medicare tax return has not yet been filed. How do I report the tip income of an employee? If your employer pays tips to your employee, list your payroll deductions from tips on the tip box for the month (you must include the amount of social security and medicare taxes you owe on the form itself--don't just list the tips you paid your employee). Tip box Deductions — smart Tax Tip box deduction deductions--you can usually deduct up to the IRS limit on the unreported tips. For tips worth up to 20 or less, include only the tips you paid out for that pay period in your pay statements. Keep the rest of the tips in a separate tip box. For tips over 20, you can claim the tip box deduction and deduct up to 20 (24 if single) on your pay statements. Where do I report unreported tips? Under the Social Security or Medicare laws, you are required to report all unreported tips in the calendar month in which the tips come in, regardless of whether they are for a single pay period or more than a single pay period.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4070a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4070a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4070a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4070a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4137